WEALTH MANAGEMENT FORMULA

You may know some people who seem to turn everything they touch into gold, while others may spend a lifetime working diligently with little to show for their efforts. Is it fate, or is something going on behind the green curtain?

We believe it’s the latter. Because in the world of wealth management, it may not be as much a matter of what you have, but what you do with what you have.

Our years of experience helping families and businesses successfully manage and preserve their wealth have produced a time-tested formula composed of the following elements.

WM = CP + IC + RM

WM (WEALTH MANAGEMENT)

=

CP (Comprehensive Planning)

+

IC (Investment Consulting)

+

RM (Relationship Management)

CP = WE + WT + WP + CG

CP (COMPREHENSIVE PLANNING)

=

WE (Wealth Enhancement: Tax Mitigation and Cash-Flow Planning)

+

WT (Wealth Transfer: Transferring Wealth Effectively; may not be within a family)

+

WP (Wealth Protection: Risk Mitigation, Legal Structures and Transferring Risk to Insurance Company)

+

CG (Charitable Giving: Maximizing Charitable Impact)

IC = INVESTMENT CONSULTING

Management of all investment elements to maximize the probability of clients achieving all that is important to them.

- Portfolio performance analysis

- Risk evaluation

- Asset allocation

- Assessment of impact of costs

- Assessment of impact of taxes

- Investment policy statement

RM = CRM + PNRM

RM (RELATIONSHIP MANAGEMENT)

=

CRM (Client Relationship Management)

+

PNRM (Professional Network Relationship Management)

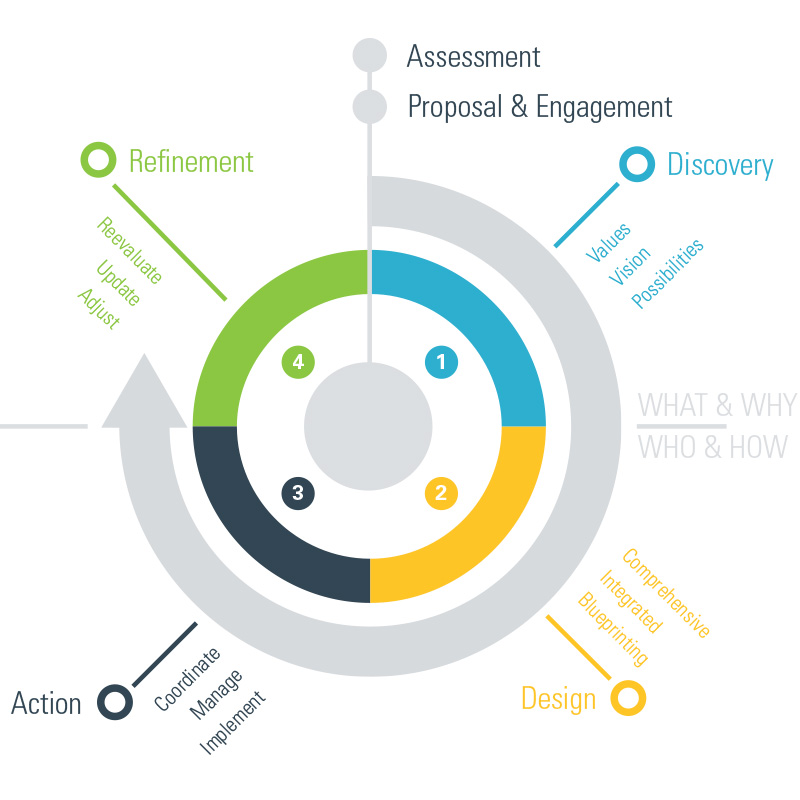

THE LIFEPRINT™ PLANNING PROCESS

Removing the Stress From Managing Wealth

Do you ever feel like money has its hold on you, sometimes even leaving you stressed out and lacking the peace you desire?

From lots of experience, we’ve seen people struggle in this fashion, even at higher levels of net worth and affluence. It’s almost like there is never enough, or it’s a relative concept or something.

Most people, however, would readily agree that they’d prefer having a clear sense that they are all set financially. They would also like to be able to tie their wealth to what they really care about. That’s the purpose of our LifePrint™ Planning Process.

Protect and Maximize the Impact of Your Wealth

Using our flagship LifePrint™ planning process, as well as our numerous tactical processes, we help individuals, families and business owners realize a secure life for themselves, plan a thoughtful legacy, and oftentimes create a lasting significance through philanthropic giving.

Together, these approaches provide an integrated and comprehensive suite of financial, estate, and tax planning, as well as investment and insurance advisory services designed to help people maximize the impact of their financial potential during life and through an ongoing legacy they can leave behind.

The Payoff: Creating Wealth With Purpose

We’ve observed that most people who have been able to create a deeper understanding and connection between their money and the things they care about most (their “purpose”), are able to realize an enhanced sense of peacefulness, freedom, and impact.

How do you begin to move in this direction? The answer is actually similar to many other areas of our lives. If we need to accomplish something outside of our realm of expertise, we find a capable, skilled, and experienced resource and delegate to some extent, right?

That’s our purpose at Wealth Impact Partners. We’re a team of experienced advisors who can help you have the right conversations and begin this process of self-discovery and strategic planning. Your LifePrint™ has so much more potential. Go after it!

OPTIMIZING YOUR INVESTMENTS

A Balanced and Complementary Approach

We believe that an optimal investment strategy is imperative for any financial plan. History has proven that interest-generating investments such as cash and bonds have relative stability of principal. However, they provide little opportunity for real long-term growth due to their susceptibility to interest rates and inflation. On the other hand, equity investments have clearly enjoyed significantly higher expected returns historically, but are vulnerable to more severe volatility risk in the markets. To balance the need for safety and performance, we use several investment platforms to bridge the gap between traditional and alternative investment strategies. They allow us to identify and design the best investment strategy for your situation, and answer questions such as:

- Am I taking too much or too little risk with my investments?

- Are my assets divided into different buckets to address different goals and different time horizons?

- Are my investments generating unnecessary taxes?

- Are my accounts being rebalanced so I stay within my risk parameters?

How your personal portfolio is structured depends on a number of variables that we incorporate into your customized design. These variables include your current stage in the financial life cycle, your risk tolerance and investment time horizons. In this way, we are able to better manage your money with an equal emphasis on risk management and investment performance.

Watch our video to learn how our balanced approach to asset allocation can help you optimize your investment portfolio.

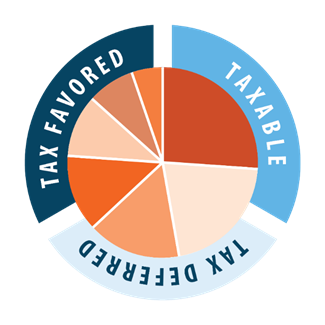

TAX OPTIMIZATION

When planning for retirement, diversification typically references an investment allocation that incorporates various asset classes. However, a truly diversified investment strategy should go one level deeper, taking into consideration the tax treatment of one’s retirement savings. We call this Diversification 2.0.

Traditionally, individuals accrue the bulk of their retirement savings in tax deferred, employer sponsored vehicles like a 401(k), but this one-dimensional savings strategy limits one’s flexibility to mitigate tax liability during retirement.

Diversification 2.0 involves accumulating investment savings in tax deferred, tax favored, and taxable accounts during our working years. Implementing a customized Diversification 2.0 strategy gives investors the ability to better control this issue by making intentional withdrawals from various retirement accounts with different tax characteristics.

One benefit of this strategy may include the reduction of necessary gross portfolio withdrawals to meet a specified income objective, preserving the longevity of a retiree’s nest egg.

TAX ALLOCATION EXAMPLES

CASE STUDY #1

This table shows the tax impact of a 60-year-old withdrawing $100,000. Assume this $100,000 comes from an investment portfolio. (Assuming current marginal tax brackets and 15% blended tax rate on taxable accounts.)

The case studies identified are hypothetical in nature and are for illustrative purposes only.

CASE STUDY #2

Two retired married couples, all age 65, are seeking $20,000 per month ($240,000 annually) after taxes and Medicare premiums.

Couple #1 has only saved in tax-deferred accounts.

Couple #2 used prudent tax diversification and saved in tax deferred, taxable, and tax favored accounts.

What is the estimated tax savings of the couple that saved in various tax accounts compared to the couple that only saved in one?

The case studies identified are hypothetical in nature and are for illustrative purposes only.

ARE YOU READY TO GET STARTED? CONTACT US TODAY!

Wealth Impact Partners

E: info@wealthimpactpartners.com

175 Highland Avenue

Suite 401 Needham, MA 02494

P: 781.489.9800

1415 W. 22nd Street

Tower Floor, Oak Brook, IL 60523

P: 847.595.1970

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Proud member of ![]()

C12 equips Christian CEOs and owners to build great businesses for a greater purpose.