PROTECT & MAXIMIZE THE IMPACT OF YOUR WEALTH

ACCUMULATING MONEY FOR RETIREMENT

Like mountain climbing, retirement planning begins with the goal of reaching the summit. The key to achieving that goal is planning and preparation.

Planning for Success

In climbing, focused planning means crafting a well thought-out route that takes into consideration the unique landscapes and challenges of the mountain. In retirement planning, it means building a plan that takes into consideration our goals and may include strategies built around retirement savings, education savings, income protection, creditor protection, investment management, tax planning and more.

Achieving Retirement Clarity

For many people, the task of retirement planning may seem overwhelming and complex. What’s missing is a clear process for HOW to build it properly. Our proprietary ARC Process™ involves performing a detailed cash flow analysis, which is then used to create a custom plan for achieving your retirement savings goals. The process also incorporates the necessary risk management tools designed to protect you from unexpected events that could obstruct your path and hinder you from successfully reaching your retirement summit.

Watch our video to learn how you can achieve clarity and peace of mind while building your retirement fund.

MANAGING RETIREMENT INCOME

While climbing to the top of a mountain is considered to be a major achievement, the real goal of climbing is not simply to reach the top, but to reach the top and return safely.

The same can be said for retirement income planning. For years, people have focused on accumulating enough assets. However, the biggest risks facing retirees occur during the income distribution phase when we retire and begin to live on our retirement savings.

As we begin this second half of our journey, we are faced with unique and potentially devastating risks such as a volatile market, inflation, liquidity, longevity, health and survivor risks. Just like climbing a mountain, those who address these risks will be more likely to safely and successfully complete the journey.

Our proprietary Retirement Income Survivor Kit or RISK Process™ is designed to help clients plan their income in retirement while simultaneously addressing the key risks associated with income distribution. We look forward to walking you through the process.

Watch our video to learn how the RISK Process™ can help you safely navigate the income risks and opportunities in retirement.

MANAGING RISK

THROUGH EFFECTIVE INSURANCE PLANNING

Few people are aware that the life, disability and long term care insurance policies they purchased as recently as five years ago might be unnecessarily costly or lacking critical new benefits due to the availability of a new generation of insurance products.

When you purchased your policies, you may have made certain assumptions about policy charges, interest rates, planned premiums, and other issues. But life is constantly changing. The original reason for your purchase may still exist, yet your needs may have changed, requiring more or less coverage. That’s why it’s important to regularly review all of your personal and business insurance coverages.

Two important aspects of financial planning involve managing risk and transferring wealth to the next generation. In many instances, the tax advantages of life insurance make it a preferred vehicle for purposes such as:

- Providing income replacement for your family and business

- Passing family and business wealth to future generations

- Providing supplemental tax-free income for retirement

- Funding business strategies such as buy-sell agreements and deferred compensation programs

- Charitable giving

Whether you are evaluating existing coverage or are seeking new insurance, Wealth Impact Partners uses several proprietary processes to:

- Help identify the type of policy that fits your current needs (Life Assurance 360™)

- Help you obtain favorable policy pricing (Underwriting Advocacy™)

- Provide on-going policy management to help connect your expectations of promised policy benefits with actual results (The Policy Management Company™)

- Advise you when your current coverage may no longer be needed (Life Settlement Advocacy Process™)

- Help you obtain quick competitive coverage for a set period of time (Term Quote Service)

A CLOSER LOOK

AT OUR INSURANCE PLANNING PROCESS

REACHING BEYOND

TO PRESERVE WEALTH FOR FUTURE GENERATIONS

What values are you hoping to support and what outcomes would you like to promote?

How much is enough to accomplish these important results?

Simply “maximizing wealth to your heirs” and “minimizing taxes” are not real goals – these are means, not ends. The key question is – for what purpose?

At Wealth Impact Partners, we believe that prudent planning starts with knowing what is in the hearts of our clients. We then learn the hard facts about your holdings. If you own a business, we assess the viability of your business’ survival to the next generation. Our team then crafts customized solutions to help mitigate transfer taxes, while making sure the provisions in your wills and trusts match what is in your heart.

MAKING A DIFFERENCE

IN THE WORLD AROUND YOU

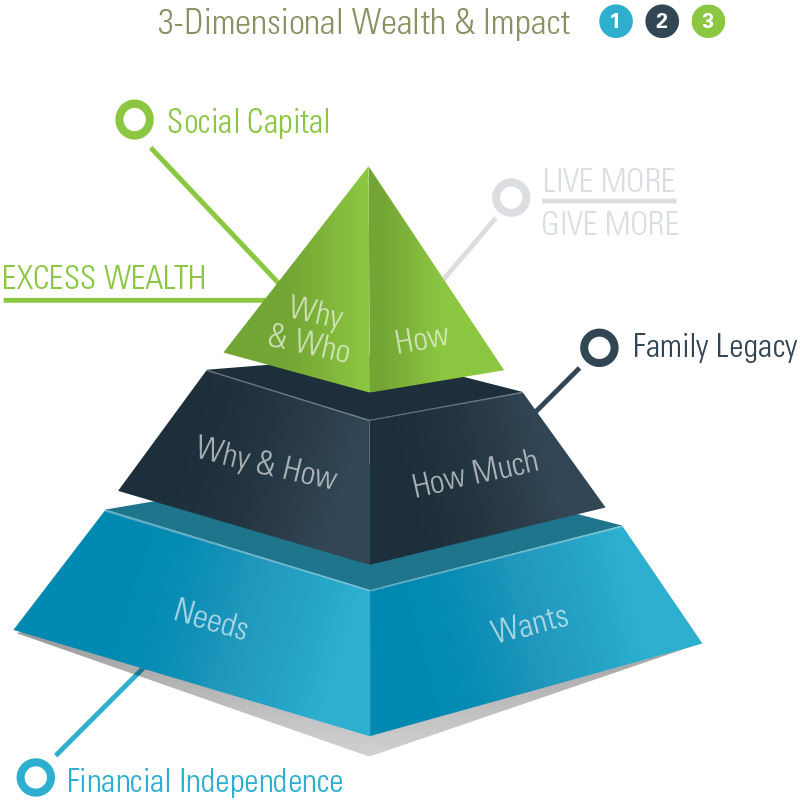

After we have made provisions for our personal needs throughout our lifetimes, and those of the next generation, we can move to the pinnacle of the planning pyramid which is social capital legacy.

Gifts to charitable causes or organizations need not come at the expense of your own financial needs or providing for your family. With the right kind of planning and expertise, you can usually redirect assets otherwise earmarked for taxes to causes and organizations that will achieve the kind of social impact you hope to make.

This is taking involuntary philanthropy and transforming it into voluntary philanthropy. Your redirected tax liabilities, along with additional wealth not required by you or your family, make up what we refer to as your “excess” wealth. Most people don’t know they have it, but they often do. If you knew you did, might you do some things differently? Live more? Give more?

If You Knew You Could Do More That Matters, Wouldn’t You?

Watch our Book Trailer to learn how you can transform your life by doing more that matters.

Ron and his co-author, Greg Hammond, are wealth and legacy advisors who deeply believe in “living more and giving more.” For over 20 years, each of them has helped individuals, families, and business owners enhance their financial standing while discovering a greater capacity to provide for their loved ones and support cherished charities.

The information, advice, and illustrations found in You Can Do More That Matters are drawn from their extensive wealth management experience. The result is a unique guide that educates and inspires readers about how to create a practical and meaningful life and legacy plan that includes making a powerful impact on the charitable organizations and causes they care about most.

You Can Do More That Matters is available through Amazon.com.

ARE YOU READY TO GET STARTED? CONTACT US TODAY!

Wealth Impact Partners

E: info@wealthimpactpartners.com

175 Highland Avenue

Suite 401 Needham, MA 02494

P: 781.489.9800

1415 W. 22nd Street

Tower Floor, Oak Brook, IL 60523

P: 847.595.1970

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Proud member of ![]()

C12 equips Christian CEOs and owners to build great businesses for a greater purpose.