Volatility Returns to Markets

In light of the recent market volatility that began last week and continued early into this week, we thought that the commentary (see document download below) from one of our portfolio management teams in Akron, Ohio might provide you with some helpful context. Looking at the recent slip in markets, one might have thought that discouraging economic data or a new geopolitical risk presented itself last week, when in reality the declines came in response to what could be positive for the markets and economy longer-term – job and wage growth increases.

So why did the market react negatively?

Last Friday, the Bureau of Labor Statistics reported that we beat expectations for new jobs in January. Average hourly wages also increased, growing 2.9% in the previous 12 months, the largest gain since 2008-2009.

The bond market reacted to the labor data by pushing the yield on 10-year treasuries to their highest level in 4 years on concerns about rising inflation and whether the Federal Reserve may increase rates more than expected this year. [3] Increases in interest rates and wages could eventually impact corporate earnings, so stock prices often adjust to account for this increased risk.

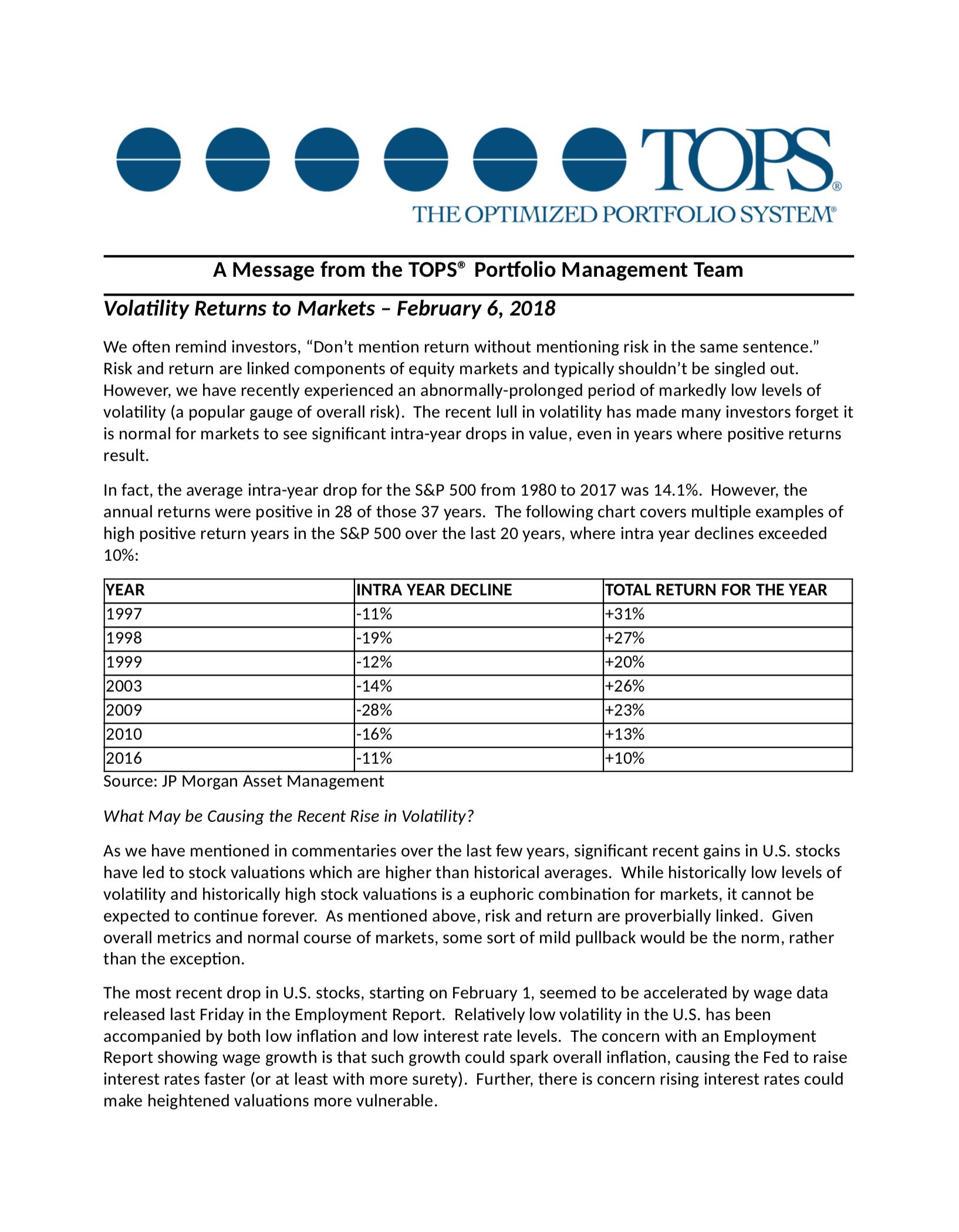

After the unusually calm markets we experienced in 2017, the recent volatility may feel unsettling, but these kinds of price fluctuations are more normal and in the longer-term, the economy remains strong.

With market indexes at record highs, viewing declines (or advances for that matter) in terms of points, rather than percentages, could cause unnecessary concerns. Despite losing nearly 1,100 points last week, the Dow was only down 4.12% and remained up 3.24% for the year.

Every market environment has risks and no expansion lasts forever. We remain diligent in analyzing these risks and their potential effects on your assets and income as we help you to grow and protect your assets for what matters to you.

We believe in the tried and true method of a strategic asset allocation, that is specifically designed to maximize your risk-adjusted returns, in light of your stated financial objectives, time horizons, and risk tolerance. With this in mind, we urge you to trust your allocation to help you through this volatility, recover timely, and resume growth on the other side. Now is the time to remain calm and not overact. Over the past 30 years, disappointing returns have often resulted from emotional investing decisions that have led to buying high and selling low, rather than trusting one’s long-term strategy through the inevitable ups and downs of the financial markets.

Disclosures:

The material contained herein is for informational purposes only and is not intended to provide specific advice or recommendations for any individual nor does it take into account the particular investment objectives, financial situation or needs of individual investors. Any tax advice contained herein is of a general nature and is not intended for public dissemination. Further, you should seek specific tax advice from your tax professional before pursuing any idea contemplated herein. This advice is being provided solely as an incidental service to our business as insurance professionals and investment advisors.

Neither Wealth Impact Partners, Valmark Securities nor its affiliates and/or its employees/agents/registered representatives offer legal or tax advice. Please seek independent advice, specific to your situation, from a qualified legal/tax professional.

Securities offered through Valmark Securities, Inc. Member FINRA/SIPC. Investment advisory services offered through Valmark Advisers, Inc., a SEC Registered Investment Advisor. 130 Springside Drive, Suite 300 Akron, Ohio 44333. (800) 765-5201. Wealth Impact Partners is a separate entity from Valmark Securities, Inc. and Valmark Advisers, Inc. BSW Inner Circle and AES Nation LLC are separate entities from Valmark Securities and Valmark Advisors.